Part 11: - Building the Nest

1957 - Building the Nest

Q1 1957

Where last year was about hubs, this year is all spokes. We’re looking to put our remaining millions into drawing the best lines of income we can.

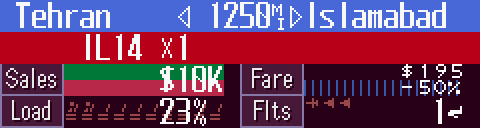

That idle DC6 is doing no good in lazing about the hangar, and neither are our unused slots in Tehran and Rome. There’s healthy demand for THR-ROM, so put assets to actions to see if it’ll pay off.

Our other routes are mostly status quo. An extra slot is thrown at Kuala Lumpur, and I continue fiddling with the fares on THR-HKG.

London carries on being an excellent use of our time.

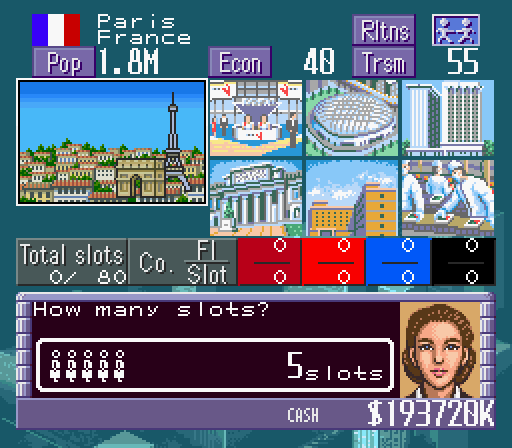

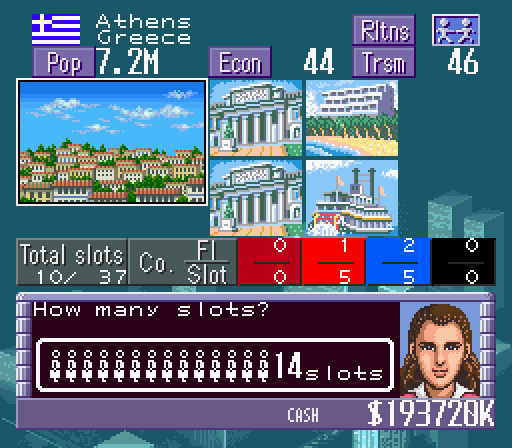

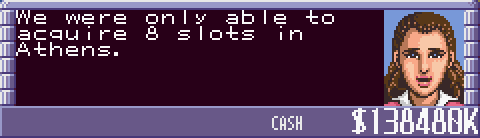

Round one of bidding is focussed on our European targets. The Greeks are unusually generous with their airport capacity, though it will take 9 months to close with them. Rome’s hesitance is just as weird, six months for five slots as if we’d just met. Nice going, Jerry.

Uh… not now.

Beijing is a fine city, sure to make excellent use of our planes, but we could connect Paris and Berlin. We’ll get back to you later, China.

I pick up extra DC6s in anticipation of those new routes.

Their first short route in Australia, and a quick bid in Pakistan.

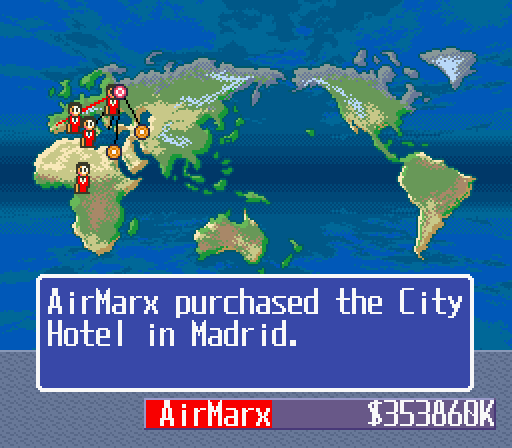

And it appears that Vickers doesn’t mind selling to the Russians. Orders of Viscounts and IL14s show a faint glimmer of hope for their choice in aircraft. They also get more busses in Spain.

Negotiations in San Francisco and Austria, and a link to the Middle East.

More fighting in Egypt, more beautiful scenery in New Zealand.

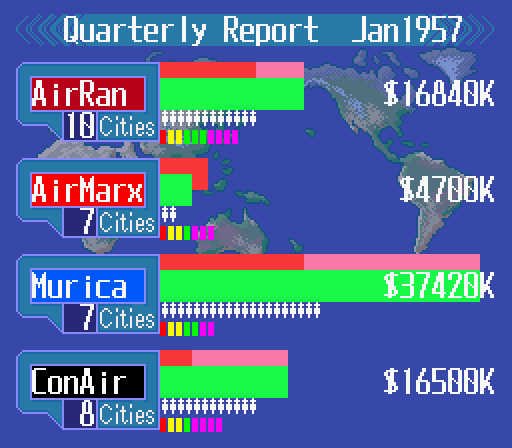

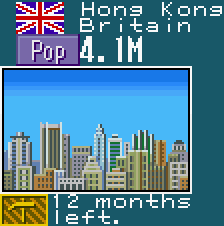

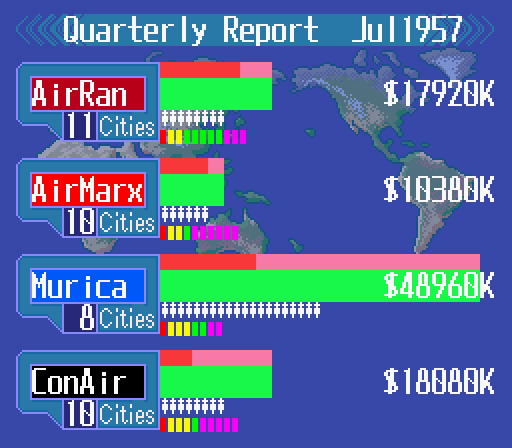

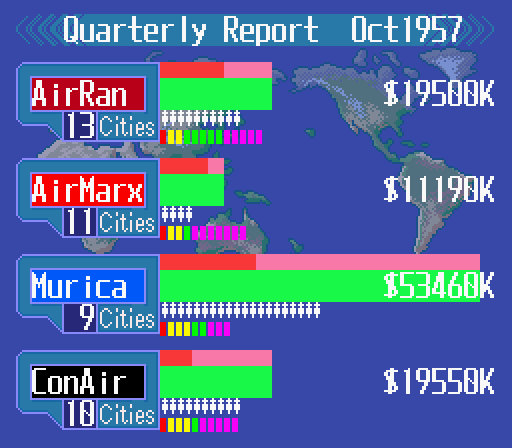

By and large a typical quarter. Slow growth from us, constant back-and-forth with ConAir, and M&M on opposite extremes of the financial spectrum.

We spend a moment on top in Europe.

Q2 1957

Just passing through.

Mostly quiet out west.

They’ve become quite fond of Spain.

It's getting quite lively over here. Our old bid in East Germany clears, I hold off on opening it for the moment. When you try to storm a region like this, you hub will quickly become a bottleneck. Setbacks in Rome mean setbacks for all of Europe.

Success in Rome is good for everyone.

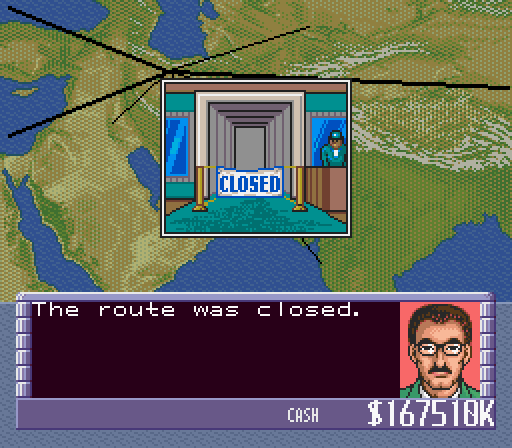

In the case of a minor downturn, we could suspend a route temporarily to avoid losses, and would be able to resume service later without paying to reopen it. Doing that does not free up our plane. Doing this serves an example to the other lines. It also refunded us $9.4 million, a bit under half of our startup cost.

China should have no trouble living up to expectations.

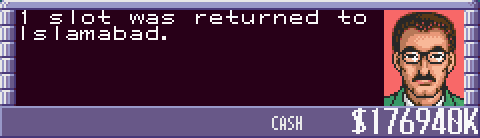

Hong Kong will do its best not to slow us down, with new slots to finish early next year.

War and Tourism continue as before.

ConAir slips ahead, and AirMarx finally posts a profit.

Q3 1957

Boeing enters the scene. Starting next year, these fellows will be up for sale. The dawn of the jet age arrives. Jet aircraft will raise the bar for operating range and passenger capacity over the current generation’s turboprops, but consume far more fuel. The Tu104 suffered from having the drawback of a jet engine without the matching advantages.

More will start to appear over the coming years.

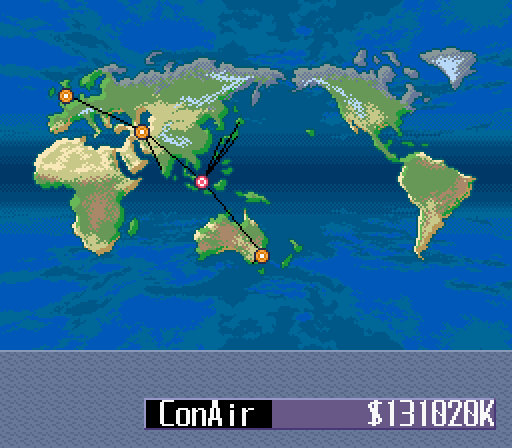

We get out first local competition from another route to Bombay and bidding in Tashkent. ConAir is setting sights on New York, so we may see some chipping away at the great blue monopoly overseas.

Bidding clears in Europe freeing Veronica to scrape up the last 3 slots we can claim in Hong Kong and Jerry to take another shot at winning over the Italians.

Quite.

We open our Franco-Prussian connections for $14.5M and $16.6M. A DC6 on each offer flights at standard fares. Another extra DC6 is ordered to throw after any route which could put it to good use.

Vienna, Rostov, and the game’s first local route in Africa.

Linking Paris, bidding in London and Pakistan.

Peace at last. We can resume business in Africa.

Not nearly the boost I’d hoped for from two shiny new Euro-flights.

Q4 1957

They keep quiet this round.

Another new route in Africa, a hotel in Austria, and some bidding in Cairo and Barcelona.

Russia.

So modest. Bids here and out east complete, giving us more time to our name.

We have perhaps overextended. I cut back flights on each route and apply some light discounts. They’re good cities, we just need to find the right setup.

Their slots, and our new DC6, are redirected to Mega-Athens, whose gargantuan population should cause most models of business to break down like the event horizon of a great Aero-Singularity. We pay $34 Million to open service.

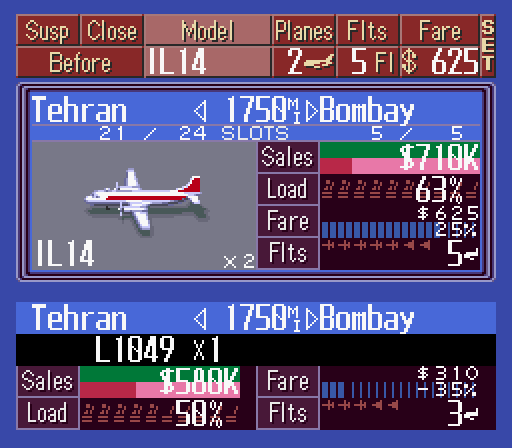

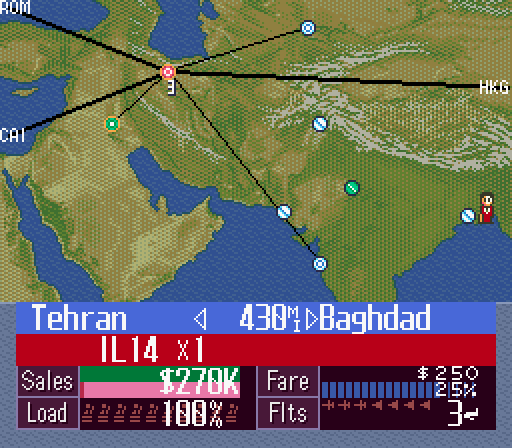

Our first taste of competition at home. We won’t get to gouge here anymore. Even then, we were earning more and spending less with our trusty IL14s. Gentle discounts will put us back at capacity.

Damnit, everywhere in China is expensive to open. Another IL14 is put to work on all 5 of those slots.

In accordance with the plan, I send out a final round of bidding. Madrid for 8, Calcutta for 14, and Singapore for 3. Their work will continue into next year.

They bid in New York, Athens, and Hong Kong, and link Vienna.

Great.

Great!

Adequate!

Profits are at record highs, though our margins are tighter. We’re lagging a bit behind ConAir financially, but keeping a bit ahead in passengers.

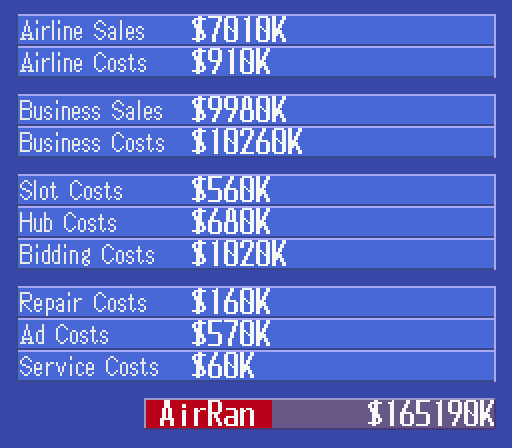

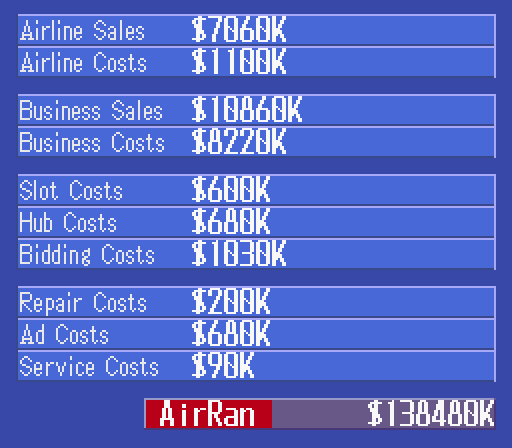

1957 Year End Review

Only Air’Murrica goes before us, setting up their hub in Mexico.

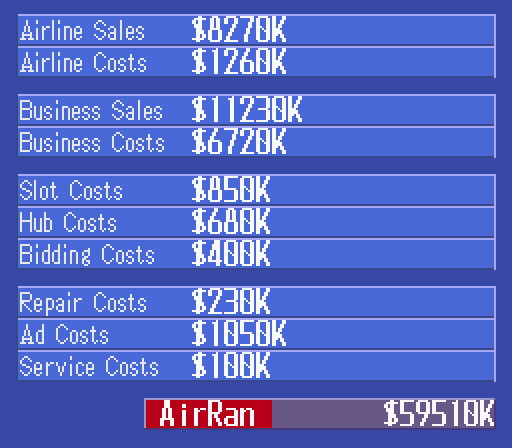

With $59 Million left in the bank, we have the capacity to throw open a few more routes before we’re completely reliant on our own income. After that, grown will come from investing in more air-time and more planes to fly it on the routes we already hold.

Let’s take a look at them.

Inter-Regionals

Connecting flights like these are typically strong revenue streams. THR-CAI has been at a capacity since we launched it, and THROM came into its own this year. Either could grow by the simple application of more time and planes. THR-HKG is lagging in comparison, with income hovering around $300K-$350K while ConAir’s competing route can fill an L1049. Usage improved a little after we linked Shanghai, leaving the impression that their advantage comes mostly from their more developed eastern network feeding people in.

$2.4 Million, 30% of our quarterly air-revenue, comes from these routes.

Middle East

Our home roots in Iraq, India, and the Uzbek SSR remain strong. The arrival of competing flights means our inflated prices will have to pop, but also prove the existence of more demand for travel which we could tap into with some extra bids. Precedent from existing routes suggests that Karachi and New Delhi would give similar performances, backed by several AI airlines going after space in Karachi. Calcutta is just a bit outside IL14 range, so if we link them it will have to be with one of our larger planes.

$1.8 Million, another 21% of our sales are from the middle east.

SE Asia

Our far east connections are paying off. They hunger for more flights and Hong Kong will soon have more time to give them. Our slots in Beijing would be expensive to activate, but nigh-guarantee another successful route.

$1.3 Million, 16% of sales come from just these two links.

Europe

London remains a credit to our network. Underperformance in Paris and Berlin kinda baffles me. Perhaps their close proximity to Rome is muffling their demand for air travel. Fucking Trains. Switching them over to smaller planes could improve margins while we wait for the routes to become more desirable, and free of big planes to pile onto more successful routes. Athens demonstrates the power of a large population to overcome all odds. Their abnormal size is easily filling our initial outreach and is sure to sustain more.

Despite setbacks with the French and Germans, $2.7 Million, a plurality of 33% of our air revenue, comes from Europe.

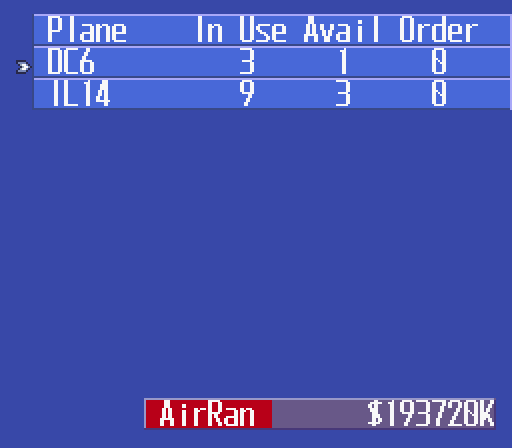

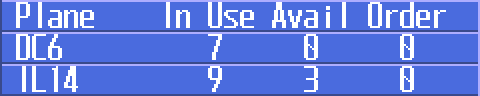

Our current fleet. 3 IL14s sit idle for want of places to go or time to fill, and two of those DC6s are being under-used on the Franco-Prussian triangle. Our increased stock of DCs is not yet enough to earn us any discounts, and hasn’t disrupted our brand-loyalty discount from Ilyushin.

Slowing Growth

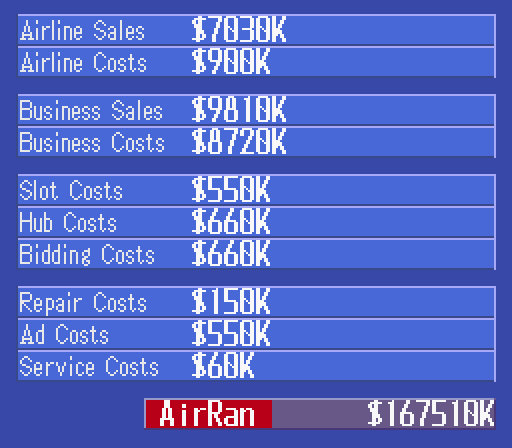

Over the course of 1957 we brought in $20.9M in operating profits, with quarterly performance peaking at $8.2M on our last turn. Our air sales have consistently improved and expanded over time, and our businesses had more ups than downs. If those trends hold, it means we’ve hit the point where our airline can pay for a new route or a couple of planes each year. If we chose the right places to apply that money, we can begin to generate some nice positive feedback to ride into the midgame. Many of our existing routes are not even tapped out yet, and could grow substantially for the minute cost of a round of bids or a fresh set of wings.

Time to make some changes for the sake of better business. Build our Plan for 1958.